When the dividend is dependable, this makes those companies a more appealing investment for people seeking passive income, such as retirees. That can help increase the value of their stock because income investors tend to value stocks based on their income yield rather than other metrics. The dividend discount model or the Gordon growth model can help investors choose individual stocks. These techniques rely on anticipated future dividend streams to value shares.

Important Dates with Regard to Dividend Payments

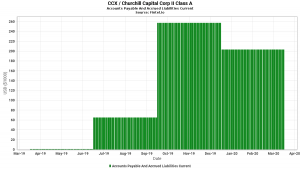

Dilution is a downside of a stock dividend if the company’s net income does not increase proportionately. We believe everyone should be able to make financial decisions with confidence. Whether as a source of income today or in the future, or for more money you can reinvest, understanding what you’re getting, when, and how much is invaluable. We hope you can use what you learned from this article can help you on your journey to being smarter, happier, and richer. These companies pay their shareholders regularly, making them good sources of income. In 2022 (the last full year prior to this writing), the REIT paid $2.967 per share in distributions.

Access Exclusive Templates

- Your monetary donations can belong to causalities that promote more useful health, fund medical investigation, stock food stakes, or sponsorship organizations that fight poverty.

- Newhouse School of Public Communications at Syracuse University with a degree in Digital Journalism.

- They can also use specific ratios, such as the dividend payout ratio or dividend yield of a company to calculate its dividends.

- A stock dividend is a payment to shareholders that consists of additional shares of a company’s stock rather than cash.

- Yet, at the same time, some of the biggest concerns on investors’ minds in 2024 are inflation risk to retirement income and market unpredictability as well as sustainable income.

- The dividend discount model or the Gordon growth model can help investors choose individual stocks.

The amount of money needed to pay a dividend is called the required payout ratio. From these conversations, they’ve found that many investors are living longer, retiring sooner than expected and prefer higher withdrawal amounts in the early stages of retirement. Yet, at the same time, some of the biggest concerns on investors’ minds in 2024 are inflation risk to retirement income and market unpredictability as well as sustainable income.

A Quick Guide To Accounting For Dividends

Companies that increase their dividend payments year after year are usually less volatile than the broader market. And the steady income from dividends can help smooth out a stock’s total return. Many investors look to buy stock in companies that pay dividends to generate a regular passive dividend income. They may be doing this to replace a salary — e.g., in retirement — or supplement their current income. Investors who are following an income-producing strategy tend to favor dividend-paying stocks, government and corporate bonds, and real estate investment trusts (REITs). Even if companies pay dividends regularly, they are not always guaranteed.

The dividend policy of a company defines the structure of its dividend payouts to shareholders. Although companies are not obliged to pay their shareholders for their investments, they still choose to do so due to various reasons mentioned above. Therefore, companies regard dividend policy as an important part of their relationship with their shareholders. There are three main types of dividend policies that companies may adopt. These include constant, residual, and stable dividend policies, based on different theories. While less common, some companies pay dividends by giving assets or inventories to shareholders instead of cash.

What do REITs invest in?

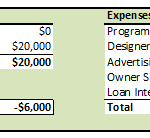

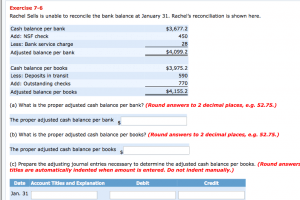

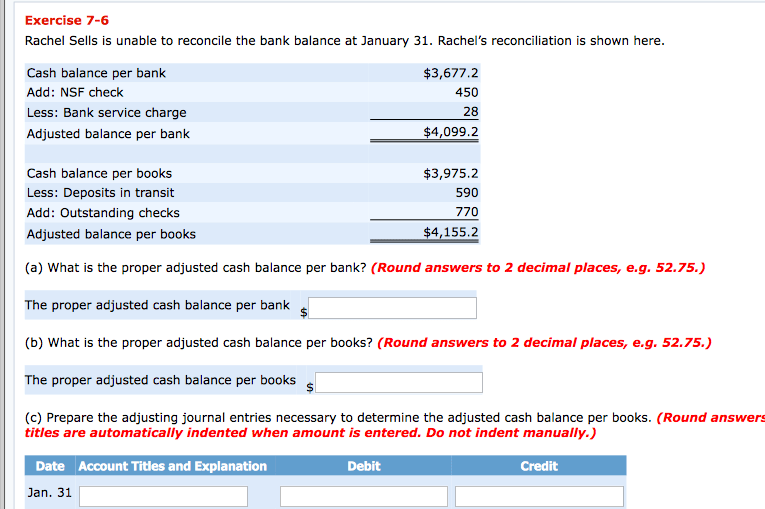

This would make the following journal entry $150,000—calculated by multiplying 500,000 x 30% x $1—using the par value instead of the market price. Gordon Scott has been an active investor and technical analyst or 20+ years. • You must have held the stock for more than 60 days in the 121-day period that begins 60 days before the ex-dividend date. Take your learning and productivity to the next level with our Premium Templates. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

How to invest in dividend stocks

One choice is to reinvest profits into the company’s growth by acquiring better equipment, marketing, and research and development. Dividends are more commonly offered by well-established companies that exhibit consistent but tempered growth over time. There are different ways to measure dividends and their value to investors. Ivana Pino is a personal finance expert who is passionate about what type of account is dividends creating inclusive financial content that reaches a wide range of readers from all types of backgrounds. Newhouse School of Public Communications at Syracuse University with a degree in Digital Journalism. If Company X declares a 30% stock dividend instead of 10%, the value assigned to the dividend would be the par value of $1 per share, as it is considered a large stock dividend.